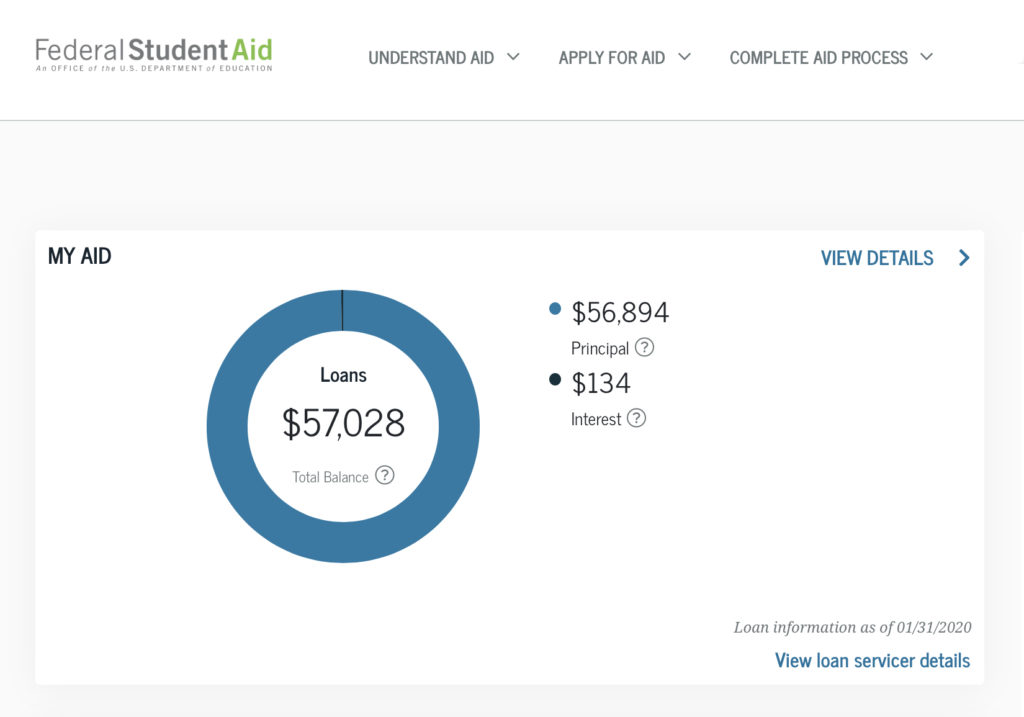

For over 10 years my wife and I have been paying into an endless black hole of student loans. While in college we accumulated nearly $200,000 in student loans. 10 years after starting to pay our loans back I still have $54,000 to pay off. Last month I had $57,028 remaining. We still have 15 years remaining before the rest is payed, assuming I paid the mimim. I no longer plan to pay the minimum. My plan is to pay them off in 3 years.

In 2008 I began my journey on becoming a physician. Medical school was my dream since I was a child. I had high hopes of becoming an oncology physician. I excelled in college and received a worthless degree in art. However a few years into medical school I couldn’t handle devoting every hour of every day studying.

I breezed through high school and college by rarely studying. The previous winter before going to Medical School I married. Medical school was a different beast than I was accustomed to. For the first time in my life I had to study for every waking second, everything else in life including my wife I had to push aside. Depression became my best friend. As a result my grades suffered. While starting out a previous coworker foreclosed a home in my name. Numerous other issues diverted my attention from school. Coincidentally to make things worse, my university lost my mock boards, telling me I had to take them again. Only to tell me later that they found them and that I scored really well.

The damage from all events amongst others unmentioned compounded in my head. With depression kicking in, the dean requested for me to attend meetings with an advisor and education specialist so that my grades would improve. Two to three more hours a week gone. A cascade of events put me over the tipping point. One day after crying in a bathtub I took a quick decision to end my journey on becoming a doctor. I went to the dean to tell them I no longer wanted to attend school. A decision to this day I regret.

Had I known, that a decade later I’d still be paying off student loans on a degree I never completed, I may have made a different choice. Maybe I would have sought more help. Maybe I would have tried harder and become numb to the world. At the end of the day, it was my choice to quit. My loans and no one else is responsible to pay for them.

Above is a snapshot of my account from January 31st, 2020. Recently this week I dropped $3000 on them to bring that number down to $54,000 give or take a few dollars. 10 years and it has gone down $40,000. 6 years ago Jolene and I sold our home, and we made the choice to pay off her 80k plus in student loans. So we were left with only mine.

Occasionally I would check my loans hoping to see that the total balance had gone down. Only to realize it wasn’t. For many years Jolene and I would pay $1300 a month with the expectation that the loans would be paid off in 25 years. Had we chosen a quicker router, we would have had to pay over $2000 a month. Two grand a month on student loans wasn’t something we could afford. Even paying $1300 a month is an ominous feeling for the loans to be payed off shortly before wanting to retire. It was a huge event when we paid off Jolene’s loans. We got lucky with the housing market. However, we were still paying $800 a month for mine.

Last year we racked up a bunch of credit card debt. Too much debt that I don’t even want to talk about it. So I looked into ways into making it disappear. We needed more money. For nearly a year Jolene looked for a new job, and I looked at ways to save money. Budgeting was key to reducing debt. Not only for credit cards, but also student loans.

Once our credit cards were paid I took money from my side businesses to pay off a $3000 student loan in December. That dropped my monthly payments by $80. With a little more money from my business I payed another $3600 in January. That dropped it another $280 combined. Currently we now pay $503 a month on my student loans. I recently sold a photo from my business and we payed another $3000 to get us to the $54,000 we owe now.

With $54,000 owed, it is my dream goal to have my student loans paid off before the summer of 2023. That seems like a huge goal especially since it has taken 10 years to get to this point. A lofty goal is still one I hope to stick to. These past 3 months paying off $10,000 has shown that it is possible.

For years, I didn’t want to put much on my loans. Paying only the mimim meant the principle never lowered. I never qualified for a loan forgiveness program since my wife makes too much. I can’t refinance, because the banks won’t include her wages in consideration. Technicalities that hurt many people. So I was stuck with having high percent loans. Three months ago I had 12 separate student loans remaining. When I started paying the student loans in chunks I began with the smallest balance. Each time a small loan was payed off, the monthly payment amount dropped. 8 loans were paid off in the past 3 months. Currently I have 4 loans remaining. Two loans at are $6000, and two are over $20,000. By mid May my plan is dropping another $3000 on one loan paying it off. Dropping my student loans monthly payments to $450. 3 loans will remain. A more manageable number. Plus the additional $50 a month will be extra to place on another loan next month. My next loan to tackle is a $6000 loan, with the two larger ones remaining.

At the end of last year I began looking at places to cut money from our budget. Jolene makes a decent wage, but we never seemed to have money left over. So I sat down and found places to cut things we didn’t need. The biggest cut, was eating out. I am not sure if it is the millennial in me, or just lack of being taught the basics about money. In reality I believe it’s the instant gratification we feel from buying something when we want it, rather waiting till we necessarily need it. All I know is that Jolene, two kids, and I were spending over $2500 a month eating out and for groceries. The last two months we decided we would change that. We still eat out once a week so that we get some fresh air. Although with the coronavirus scare, that might be even less soon. Since I generally take care of the kids, that has meant that I have had to learn more recipes to cook and much more dishes to wash. Roughly we are spending about $600-$700 a month now on food and supplies. A huge difference from the $2500 that kept us in the red every month.

I then began to look at other areas of our budget. Dog food we were spending over $100 a month. I have switched dog foods and am spending $75 a month. That’s a $300 saving on the year. Now I know many people probably spend even less money on dog food or don’t have an animal at all. I feel it’s necessary to feed a good dog food, so that I don’t have to spend money on medical bills down the road. That’s an entire different topic.

I recently purchased different Auto Insurance. It only dropped $5 a month, but I received double the coverage from Geico. That’s still a saving of $60 on the year. I could have saved even more with less coverage, but the piece of mind not having to worry about a potential accident is comforting. Even a little bit can go a long way.

Since I was a teenager I have cut my own hair with a haircut kit. The last two years I began having it done by a barber. I enjoyed the experience with my son getting our hair cut together. That hair cut was about $36 bi-monthly. I chose to cut that out for now. That saves us around $200 a year.

We stopped making long trips to visit family. Most of our family live 30-60 minutes away. We were driving multiple times a week, if not every day Jolene didn’t work to see family. That was costing hundreds of dollars a month in gas. That alone is saving at least a $1000 a year. Yes that means less social interaction, but financial success in more beneficial in the short term.

Another cut is washing our cars. We used to get our car washed every so often. A few hundred dollars a year saved by washing it ourself with a cheap bottle of car wash soap.

Another expense cut, involves clothes. Jolene swore by using Tide to wash our clothes. Having young children who can dirty their clothes in a matter of hours means having lots of clothes to wash. Tide is super expensive. We now use a cheaper brand that is 1/4 in cost. Sure the clothes don’t last as long, but since my kids grow so quickly they don’t need to wear those clothes for long anyway.

Another area of cost was utilities. In the summer and winter months, our electrical bill would reach $300 a month. We just went to solar. Based on estimates of $.15 per kWh, we should pay no more that $150. We were paying $.15, $.25, and $.42 a kWh before depending on the tier we used that month. We will be saving a decent amount a month there especially as it gets hotter.

Now I know I am rambling on. The key to my madness in writing, is that I finally sat down and wrote a budget. There are still some areas that I want to save money on (ex. stop paying to stream tv and giving up soda), but for now we have made a huge change. Roughly a $3000 a month change when all said and done and estimating for Jolene’s new job. For the first time in our marriage we are actually living under budget and not paycheck to paycheck. Which is a good feeling.

Many years ago Jolene and I made the decision that I would take care of the kids while she works. We didn’t want them to be raised by daycare providers, or anyone other than us. In todays world, and in California where cost of living is much more, it is difficult to live off of one salary. That is not to say that I don’t make money. Our budget though is based solely off of my wife’s income. Everything I make will be extra, and go to emergency expenses.

Part of achieving our goals of paying off my loans will be predicated on me making passive income. I used to run two different businesses that made a decent amount of income. I decided not to do those for various reasons and the inconsistencies of income. However, the skills I obtained doing them is being placed into my current home businesses. Last month I made $500 selling aquacultured coral. That amount fluctuates monthly, but I also have other avenues of income. I make money from my websites through ads. When someone clicks a link on my many sites, I could possible receive revenue from it. I’ve also sold photos etc which can be exciting. Additionally, I also occasionally make money from a third business. However, that could make 10-20k (some years less) a year depending on how successful the year is.

With all of our income, aside from mine, we have about $2,500 a month excess. That’s $30,000 a year. Since we like to travel we plan on two trips a year. Traveling for me is a requirement, as I believe it helps my marriage as well as open my children’s minds to the world. With such a large expense, that leaves us with $20,000 each year to place on my student loans. By my crude calculation in 3 years we can be free of student debt. If we chose not to travel for a couple years, we could pay it off even sooner.

Now I know very few people will read this and find it entertaining. In reality it is a way for me to write my thoughts and hold myself accountable. It’s a way of writing my goals in virtual concrete with the hopes of seeing if we follow through with them. So follow us on our journey of paying off the rest of our student loans. $54,000 remaining in 3 years.

Copyright © 2017 Daddy's Turn. All rights reserved.